Have you ever asked yourself “how is my credit score calculated?” If you’re like most Americans, you have. You’ve probably even been rejected when applying for a loan or a credit card because of your credit score. The good news is you’re not alone, you’re about to learn what your credit score is made of, and we can even help you improve your credit.

Your credit score is the three-digit number that determines if you’ll be approved for credit cards, car loans, home mortgages, and much more—and the higher the score, the better your chances are of being approved. So, how’s it calculated? What’s a good score? And how can you improve your credit?

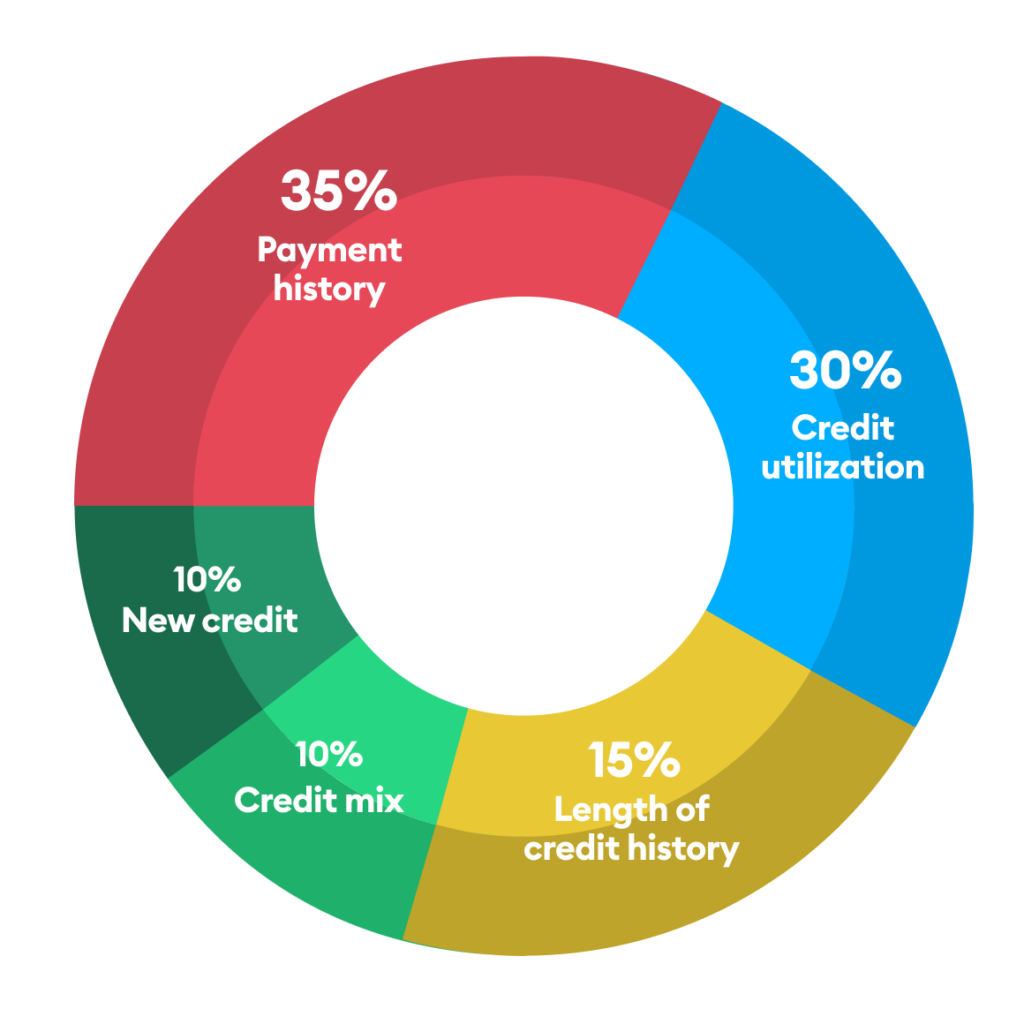

How is my credit score calculated?

Payment history

- This counts for 35 percent of your credit score, which makes it the single most important factor. Your payment history is a record of whether you have paid your past bills on time or not. If you pay a bill more than 30 days late, it lowers your credit score. A positive payment history shows that you can reliably pay back your debts.

Credit utilization

- How much of your available credit you use, counts for 30 percent of your credit score. Credit utilization refers to what percent of your credit limit you use—the less credit you use, the better this is for your credit score. Using less than 30% of your credit can boost your credit score. For example, if you have a credit card with a $300 limit, spending less than $100 on it will help your credit score. Your credit utilization shows lenders that you can borrow responsibly.

Length of your credit history

- This counts for 15 percent of your credit score. The older your accounts are, the more they help your credit score. Even if you no longer use an account or credit card, keeping it open will help increase the length of your credit history and boost your credit score. A mature credit history tells lenders that you have experience holding accounts and managing your credit.

Credit mix

- Makes 10 percent of your credit score. Your credit mix is the type of credit accounts you have, such as credit cards, car loans, mortgages, or personal loans. Having a range of different kinds of credit can help your credit score because it shows that you can successfully manage many types of credit.

New credit

- The remaining 10 percent of your credit score is your credit mix. New credit is the number of credit accounts you’ve opened recently and the number of “hard” inquiries made by lenders when you apply for credit. Opening too many new accounts in a short span of time can hurt your credit score because it can make you seem risky to lenders. It’s better to apply for credit only when you need it and space out new credit accounts.

What are the credit score ranges?

Now that you know how your credit score is calculated, let’s look at the different ranges. Credit scores typically range from 300 to 850, but most lenders will not approve loans or credit cards for people with scores below 635.

- 800 to 850: Excellent

- These are low-risk borrowers. They may have an easier time securing a loan, and one at better rates, than borrowers with lower scores.

- 740 to 799: Very good

- If you’re here, it means you’ve demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good

- Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair

- This group is considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor

- Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, you’ll likely need to improve your credit scores before you can secure any new credit.

How can I improve my score?

Brigit’s Credit Builder* helps you build your credit and save money at the same time.

- We’ll help you open a 24-month loan and keep the funds in a locked deposit account in your name. This starts building your credit history and improves your credit mix.

- Choose how much you’d like to contribute towards your monthly payment—$1 to $25. Your contribution will become savings that you can withdraw at any time.

- Your monthly payments help show positive payment history—the largest factor in your credit score (remember that payment history counts for 35 percent of your credit score).

- Each payment is reported to the three major credit bureaus—Experian, Equifax, and TransUnion.

*The Brigit Credit Builder is a service provided by Brigit and its bank partner, Coastal Community Bank, Member FDIC. The Brigit Credit Builder product is separate from the Brigit Instant Cash Advance service. Brigit Credit Builder installment loans are issued by Coastal Community Bank, Member FDIC, subject to approved underwriting practices.

Impact to score may vary. Some users’ scores may not improve. Results will depend on many factors, including on-time payment history, the status of non-Brigit accounts, and financial history. Results show that customers with a starting credit score of 600 or below were more likely to see positive score change results. A Brigit subscription is required. Credit Builder loans are not available in all states.

Banking services provided by Coastal Community Bank, Member FDIC.

Source: FICO